What is RATIO?

With RATIO, this vision is now reality.

- per troy ounce (31,103 g)

-

Trend silver rather

favorable to gold

- per troy ounce (31,103 g)

| USD | EUR | |

|---|---|---|

| Gold price | 3641.88 $ | 3100.42 € |

| Silver price | 42.54 $ | 36.22 € |

| Ratio (GSR) | 85.61 | 85.61 |

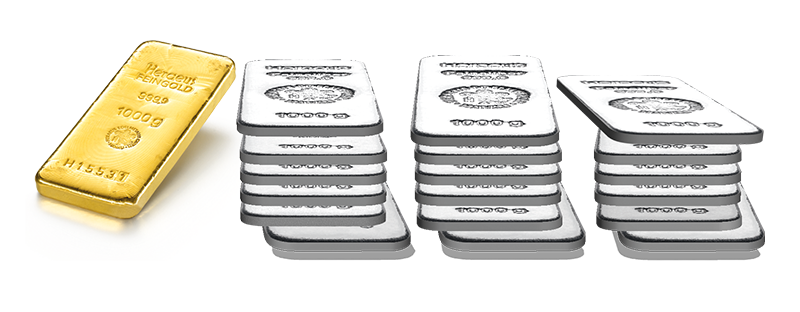

18kg silver for 1kg gold -> ratio 1 to 18

| Period | Relationship of gold to silver | EUR / 1kg gold |

|---|---|---|

| May 1980 | 1 to 18 | 16.178,83 € |

| Jul. 1991 | 1 to 97 | 11.577,27 € |

| Sep. 2011 | 1 to 34 | 45.373,66 € |

| Mar. 2018 | 1 to 80 | 37.888,86 € |

| Feb. 2021 | 1 to 64 | 49.753,87 € |

| Sep. 2022 | 1 to 96 | 54.949,03 € |

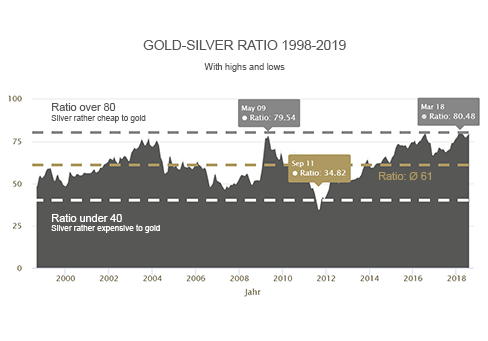

As at: 04/2019

Why RATIO?

Benefit from our many years of experience - we'll explain the possibilities of precious metals to you.

Use the advantages and switch your precious metals to achieve the best result.

Save from €100 monthly in gold and silver.

Benefits

Use the gold-silver RATIO.

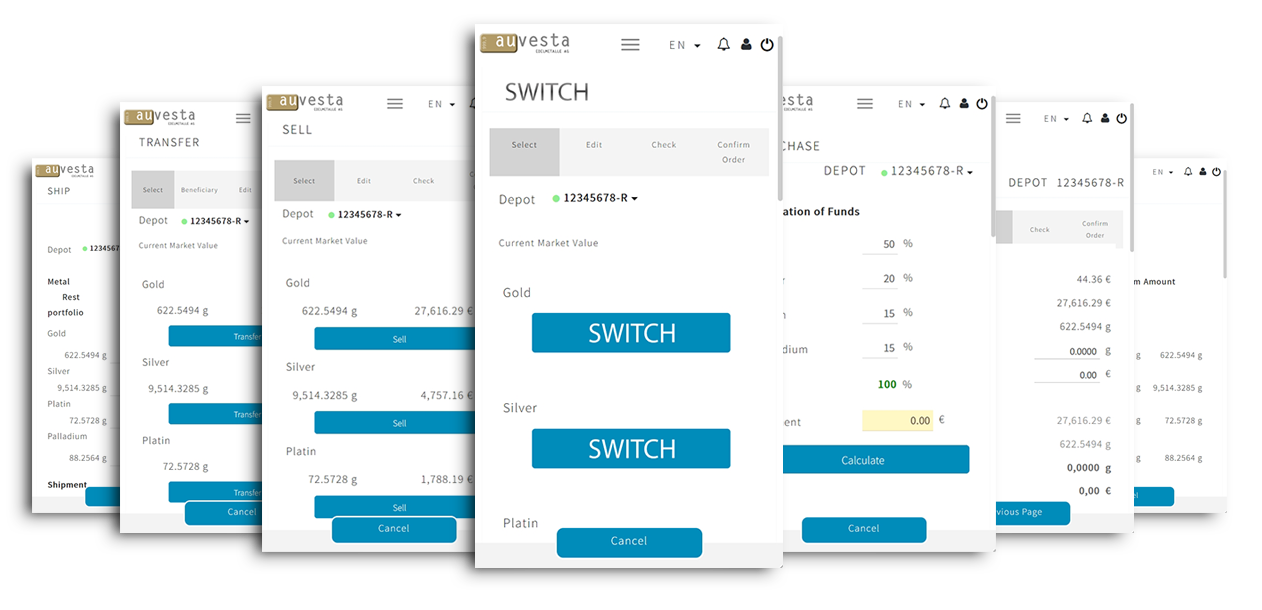

Purchase

Buy gold worldwide easily online.Switch

Sell one precious metal and buy another precious metal.Transfer

Send and receive gold free online.Storage

Manage your inventory, ingots, stock account, control and daily balance.Sales

Sell gold worldwide online down to the cent.Cash plan

Set up once, pay regularly

Gold-silver ratio

Anyone who invests in precious metals is faced with the question of whether gold or silver is better. There are also other precious metals such as platinum or palladium. But gold and silver are the most sought-after precious metals. The gold-silver ratio helps you to derive buy or sell signals. This ratio can support you in your decision.

How does ratio work?

They divide the price of gold by the price of silver.

- A gold-silver ratio of 80 means

:

The silver price is 80 times cheaper than the gold price.

In the past, a RATIO of 80 or higher has proven to be a buy signal for silver. - A gold-silver ratio of 40 means

The silver price is only 40 times cheaper than the gold price.

In the past, a RATIO of 40 or lower has proven to be a sell signal for silver.

Your Online Depot

How does it work?

Buy physical gold, silver, platinum and palladium.

Purchase fractional ownership of large bullion bars (industrial bars) at more favorable average prices in “Good Delivery” standard.

1st place – for the 5th year in a row!

Handelsblatt 2025:

Auvesta “Best Provider of Gold Savings Plans”

Auvesta Edelmetalle AG has once again been recognized by Handelsblatt as the

“Best Provider of Gold Savings Plans.”

In an independent customer survey by ServiceValue GmbH, Auvesta stood out from 14 providers during

2021–2025 for outstanding customer satisfaction, transparency and service quality.

With Auvesta you can invest in precious metals flexibly and securely – with a personal gold savings plan or precious metals account. Starting from small monthly amounts you acquire physical gold, silver, platinum or palladium, which can be insured and stored or delivered upon request.

Put your trust in the multiple award-winning test winner – start now with your individual savings plan in real assets!

Our online deposit account

Performance

| ⌀ | 9.44% |

| ⌀ | 8.56% |

| ⌀ | 4.57% |

| ⌀ | 12.47% |